You have until March 3, 2025, to make RRSP contributions that will qualify as tax-deductible for your 2024 return.

Contribution limits for 2024 tax year

The maximum RRSP (Registered Retirement Savings Plan) contribution limit is 18% of your 2024 earned income or $31,560 (whichever is lower), plus any unused contribution room from previous years. You can check your RRSP limit through your CRA My Account.

Pro Tip: Avoid over-contributing. If you exceed your contribution limit by more than $2,000, you’ll face a penalty tax of 1% per month on the excess amount.

Contributon deadline

The deadline for 2024 contributions is March 3, 2025. Contributions made by this date can be deducted from your 2024 taxable income.

If you miss the deadline, you can still contribute to your RRSP, but those contributions will only be deductible for your 2025 tax return. Missing the deadline could mean losing out on significant tax savings for 2024.

Contributing early or on time provides these key benefits:

- Immediate tax savings: Lower your taxable income for the year and potentially get a refund.

- More time for growth: The earlier your money is invested, the more time it has to grow through compounding.

- Avoid last-minute stress: Rushing to contribute near the deadline can lead to mistakes or missed opportunities.

Pro Tip: Set up automatic monthly contributions for effortless saving.

The RRSP contribution period (from January 1 of the current tax year to 60 days into the following year) is designed to give you flexibility. It allows you to contribute when it’s most financially feasible for you, whether that’s during the year or early in the next year. This helps you maximize tax deductions and avoid over-contribution penalties.

Contribution after deadline

The contributions received after March 3, 2025, will be applied to your 2025 RRSP contribution room. While your savings will still grow, you’ll miss the opportunity to claim them on your 2024 taxes.

Contributions over the limit

If you’ve contributed more than your allowable limit, CRA allows a $2,000 over-contribution buffer without penalties. Beyond that, you’ll incur a 1% penalty tax per month. To fix this, withdraw the excess or request a waiver from CRA if the over-contribution was accidental.

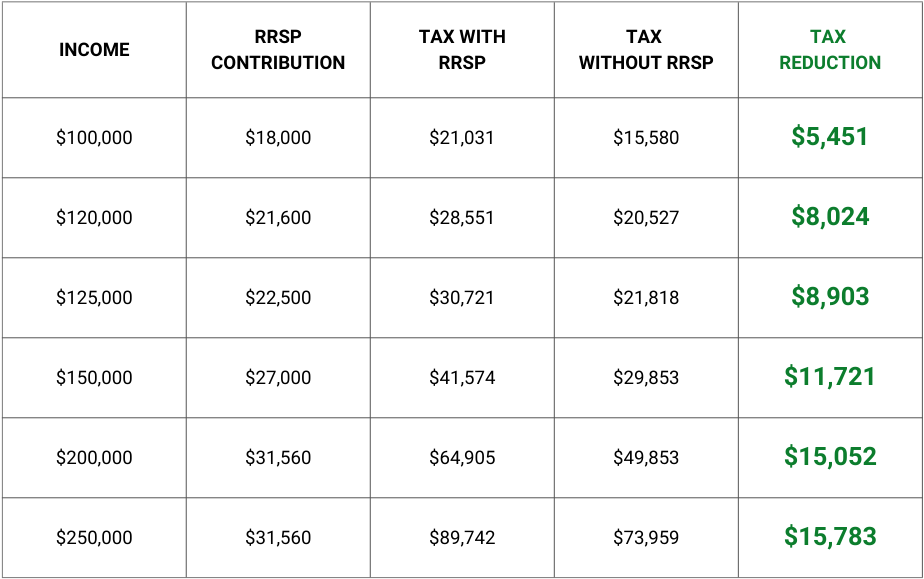

Here's how much you can save on tax at various levels of income:

If you need help finding your contribution room or would like professional advice regarding how to make your registered account tax efficient, contact our trusted finance partner Grey Elm.

Invest your RRSP for faster growth

Hosper MIC offers a straightforward option to invest your RRSP in real estate-backed mortgages across Ontario, allowing your RRSP to earn passive and predictable monthly dividends, re-invested for faster compounding growth.

- Above-market returns: Earn passive and predictable monthly dividends, re-invested for faster growth.

- High security: Invest with peace of mind knowing your funds are backed by real properties in Ontario. See Hosper's Paragon Process.

- No management fees: Keep more of your earnings as we charge 0% management fees, so your dividends go directly to you.

- Flexible options: Choose from 3 different share classes to match your investment goals.

Learn more about investing your RRSP in Hosper MIC or get in touch with our investment team at

.png)