Why We Trust the Process

The Paragon Process. Mortgage Investments Protected

Paragon is Hosper’s control framework.

Every mortgage is rigorously underwritten, legally verified, and actively serviced. We take hands-on management to recover your investment in any instance of default.

14%

Rates Up To

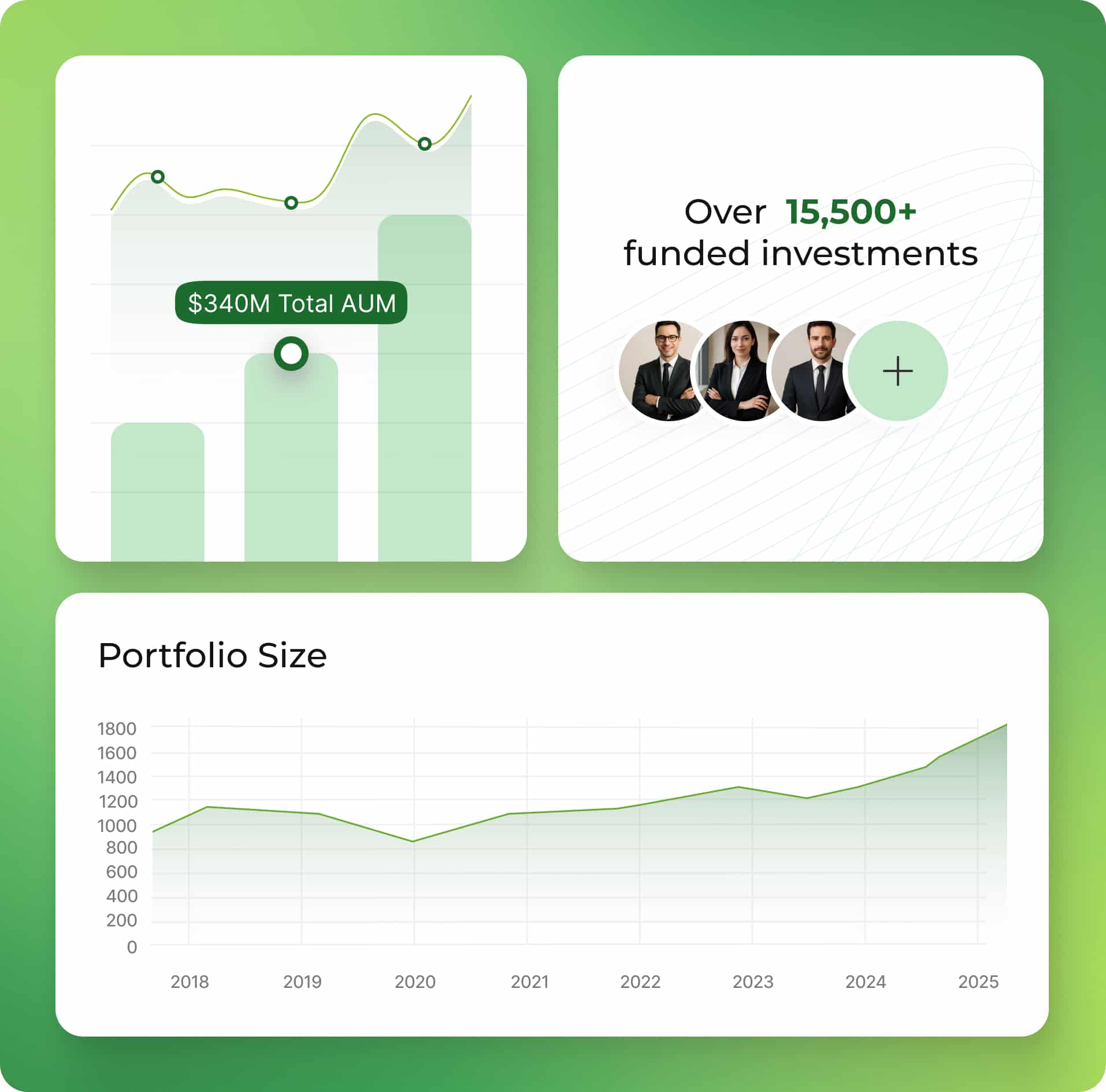

$1.2B

Funded Mortgages

8,000+

Investors to Date

Assisting Brokers, Serving Investors

Paragon Works for You

Paragon powers our mortgage investment platform. We combine disciplined underwriting, legal verification, and hands-on servicing to protect capital and keep income consistent for investors while giving brokers quick, clean approvals and closings.

With scale, transparent reporting, and responsive support, you can invest through our MIC funds or select deal-by-deal opportunities with confidence. Clear terms, fast feedback, and accountable management in any market.

Because of our Paragon process, Hosper Mortgage is able to fund higher LTV and trickier mortgages than other lenders who aren’t willing to roll up their sleeves. The Paragon process is an active management strategy that involves significant effort and specific industry partners.

It’s a lot harder for our competitors to replicatte our framework

Contact Us

Your Next Opportunity Starts Today

Take the next step toward earning passive income with Hosper Mortgage. Contact us today for a personalized consultation or to request our investor kit.

Our experts will walk you through the options and help tailor a mortgage investing/funding plan to your needs.

We Respond Within 2 Business Hours