Slide 1

MIC Class B

Comfort Fund

This Comfort Fund is designed to be our lowest risk mortgage fund. The fund’s objective is to deliver a 6.5% target return to investors by maintaining a diversified lower-risk mortgage portfolio. This approach is designed to provide consistent returns secured by real estate, both in times of growth and in times of uncertainty. Participating investors can choose to collect monthly cash payments, or re-invest their dividends for faster growth. Some eligibility requirements apply.

6.5% Target Rate of Return

RRSP & TFSA Eligible

Monthly Dividends with Re-Investment Option

Diversify Across Ontario

100% Residential Mortgages

100% First Mortgages

The rates of return may vary as a result of risks associated with mortgages. Principal and interest are not guaranteed. Only investors who do not require immediate liquidity of their investment should consider a potential purchase of Hosper Funds.

Request MIC Fund Fact Sheets

Request MIC Offering Memorandum

Request MIC Financial Statements

Our Investor Requirements

$30k minimum investment

Satisfy eligibility requirements

Exclusive to Canadian investors

One-year

commitment

commitment

6.5% Target Rate of Return

Start Investing

With our Comfort Fund, investors can confidently access a lower-risk mortgage portfolio that aims to deliver an attractive 6.5% target return. Focused on maintaining diversification, this fund offers consistent returns secured by real estate assets, providing stability in both prosperous and uncertain economic conditions. At Hosper Mortgage, we prioritize your financial security, and this fund represents an excellent opportunity to build a reliable income stream while mitigating potential risks.

Our Comfort Fund's strategic approach grants participating investors the flexibility to choose between monthly cash payments or reinvesting dividends for accelerated growth. This tailor-made flexibility empowers investors to align their investment strategy with their financial objectives, making it suitable for both short-term income seekers and those aiming for long-term wealth accumulation. You're in control of your financial journey with Hosper Mortgage.

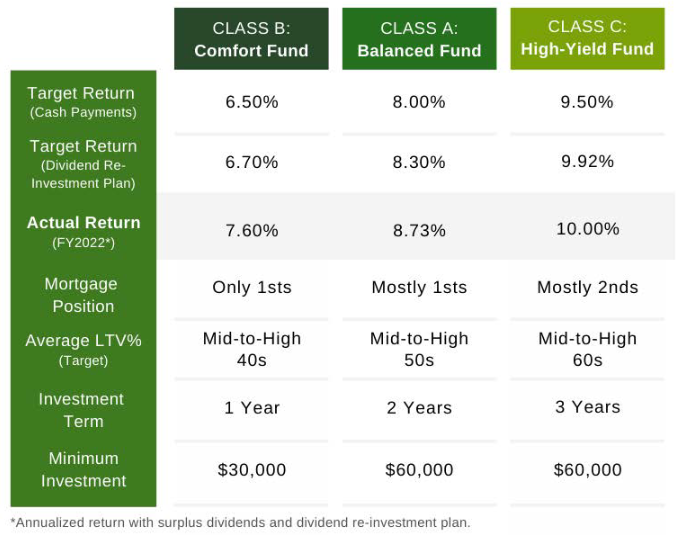

Fund Comparison Chart

To ensure optimal performance and risk management, our Comfort Fund maintains strict eligibility requirements for investors. These guidelines are designed to safeguard your interests and the fund's overall stability. By adhering to these criteria, we foster an environment of trust and transparency, where our investors can confidently rely on our expertise to protect their investments and maximize their returns.

Discover the unique benefits of our Comfort Fund and experience the potential of secured real estate-backed returns. Whether you're a seasoned investor looking to diversify your portfolio or a newcomer seeking a reliable income stream, our fund offers the perfect balance of stability and growth. Partner with Hosper Mortgage today, and together, we'll build a stronger financial future.

Start Investing

Offering documents stipulate that ~90% of the portfolio will be invested in 1st position mortgages. The LTV average of the Fund will fluctuate from time to time and may increase up to the maximum threshold set out in the Offering Memorandum. Offering documents available upon request.