Slide 1

MIC Class A

Balanced Fund

The Balanced Fund’s objective is to deliver an 8% target return to investors by maintaining a diversified mortgage portfolio. This approach is designed to provide consistent returns secured by real estate, both in times of growth and in times of uncertainty. Participating investors can choose to collect monthly cash payments, or re-invest their dividends for faster growth. Some eligibility requirements apply.

8% Target Rate of Return

RRSP & TFSA Eligible

Monthly Dividends with Re-Investment Option

Diversify Across Ontario

100% Residential Mortgages

Mostly First Mortgages

The rates of return may vary as a result of risks associated with mortgages. Principal and interest are not guaranteed. Only investors who do not require immediate liquidity of their investment should consider a potential purchase of Hosper Funds.

Request MIC Fund Fact Sheets

Request MIC Offering Memorandum

Request MIC Financial Statements

Our Investor Requirements

$60k minimum investment

Satisfy eligibility requirements

Exclusive to Canadian investors

Two-year

commitment

commitment

8% Target Rate of Return

Start Investing

At Hosper Mortgage, our Balanced Fund offers investors an enticing opportunity to achieve an impressive 8% target return. This fund is strategically crafted to maintain a diversified mortgage portfolio, ensuring a well-balanced mix of investments. By harnessing the power of real estate assets, investors benefit from consistent returns that withstand fluctuations in the market, providing stability and peace of mind.

With the Balanced Fund, we empower our valued investors with the freedom to tailor their investment experience. Whether you prefer a steady stream of monthly cash payments or desire to capitalize on faster growth by reinvesting dividends, our flexible options cater to your unique financial goals. This personalized approach aligns with your investment strategy and sets you on the path to financial success.

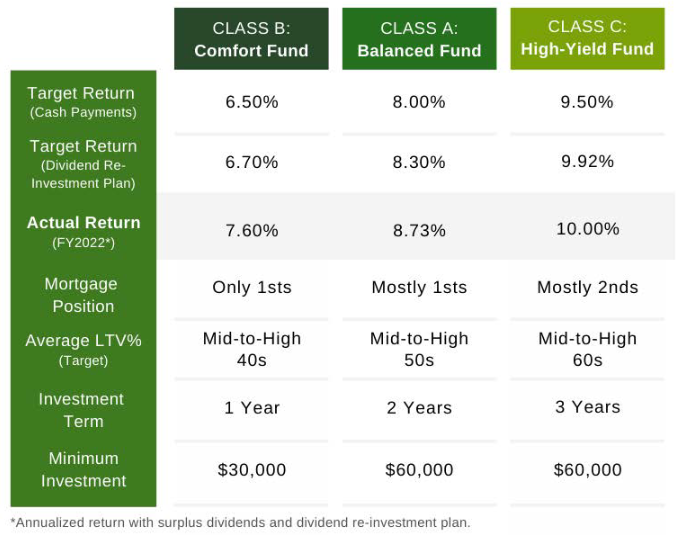

Fund Comparison Chart

Transparency and trust are integral to our investment philosophy. To maintain the fund's integrity and safeguard our investors' interests, the Balanced Fund adheres to stringent eligibility requirements. These measures are in place to ensure the fund's continued success and to cultivate a robust community of investors who share in our commitment to responsible and rewarding investments.

Elevate your investment journey and unlock the potential of the Balanced Fund. Experience the benefits of a diversified mortgage portfolio secured by real estate assets, providing you with growth and stability simultaneously. Whether you're a seasoned investor seeking to enhance your portfolio or a novice looking for reliable returns, Hosper Mortgage' Balanced Fund offers a secure and promising avenue for financial prosperity. Partner with us today and seize the opportunity to thrive in your investment endeavors.

Start Investing

Notice: Offering documents stipulate that ~70% of the portfolio will be invested in 1st position mortgages. The LTV average of the Fund will fluctuate from time to time and may increase up to the maximum threshold set out in the Offering Memorandum. Offering documents available upon request.