Investing your TFSA (Tax-free Savings Account) funds in Mortgage Investment Corporations (MICs) or direct mortgages offers potential for tax-free income and diversification within your investment portfolio. Here’s a step-by-step approach to get started:

1. Research private mortgage investing

- Understand your options: Familiarize yourself with Mortgage Investment Corporations (MICs) and direct mortgage investments. MICs pool investor funds to invest in a diversified portfolio of mortgages, while direct mortgages involve lending directly to borrowers. MICs typically offer higher security, while direct mortgages offer higher returns.

- Compare investments: Research different MICs and direct mortgage opportunities available through financial institutions or private lenders. Compare factors such as returns, risks, fees, and investment terms. Make sure to share your goals and expectations with the investment representative to ensure you are participating in the best investment option to fit your palate.

2. Check TFSA eligibility

- Review TFSA contribution limits: Ensure you have available contribution room within your TFSA. The annual contribution limit is set by the Canadian government and accumulates each year.

- Confirm investment eligibility: Verify that your TFSA provider allows investments in MICs or direct mortgages. Some financial institutions may have restrictions or specific guidelines for alternative investments.

3. Choose your investment approach

- Select a MIC: Choose a reputable MIC with a proven track record and transparent investment practices. Evaluate factors such as historical performance, management team expertise, and portfolio diversification.

- Explore Direct Mortgages: Alternatively, explore opportunities to invest directly in individual mortgages.

4. Conduct due diligence, evaluate and choose your mortgage administrator

- Review investment opportunities: Thoroughly review the offering documents provided by the company you chose. Understand investment objectives, risks, fees, and potential returns.

- Understand risks involved: Consult a legal and/or financial advisor to ensure you understand the legal implications and risks associated with investing in mortgages. The company’s representative is also responsible for disclosing any risks and ensuring that you are comfortable with your investment.

5. Open or transfer funds to a self-directed TFSA

- Open a self-directed TFSA: If you don’t already have one, open a TFSA with a provider that allows investments in MICs or direct mortgages. Most private lending companies will require you to open a self-directed TFSA account as major banks have limited investment freedom.

- Transfer funds: Transfer funds from your existing TFSA or other eligible accounts to your new TFSA designated for investment in MICs or direct mortgages.

6. Invest in MICs or Direct Mortgages

- Complete the investment process: Submit the necessary applications and documentation to invest in the chosen MIC or direct mortgage opportunity.

- Transfer funds: Instruct your TFSA trustee or administrator to transfer funds from your TFSA account to the MIC or directly to the borrower in the case of direct mortgage investments.

Assess the performance of your MIC or direct mortgage investment regularly. Consider adjustments to your investment strategy based on market conditions, changes in your financial goals, or new investment opportunities.

How to get started with investing in Hosper?

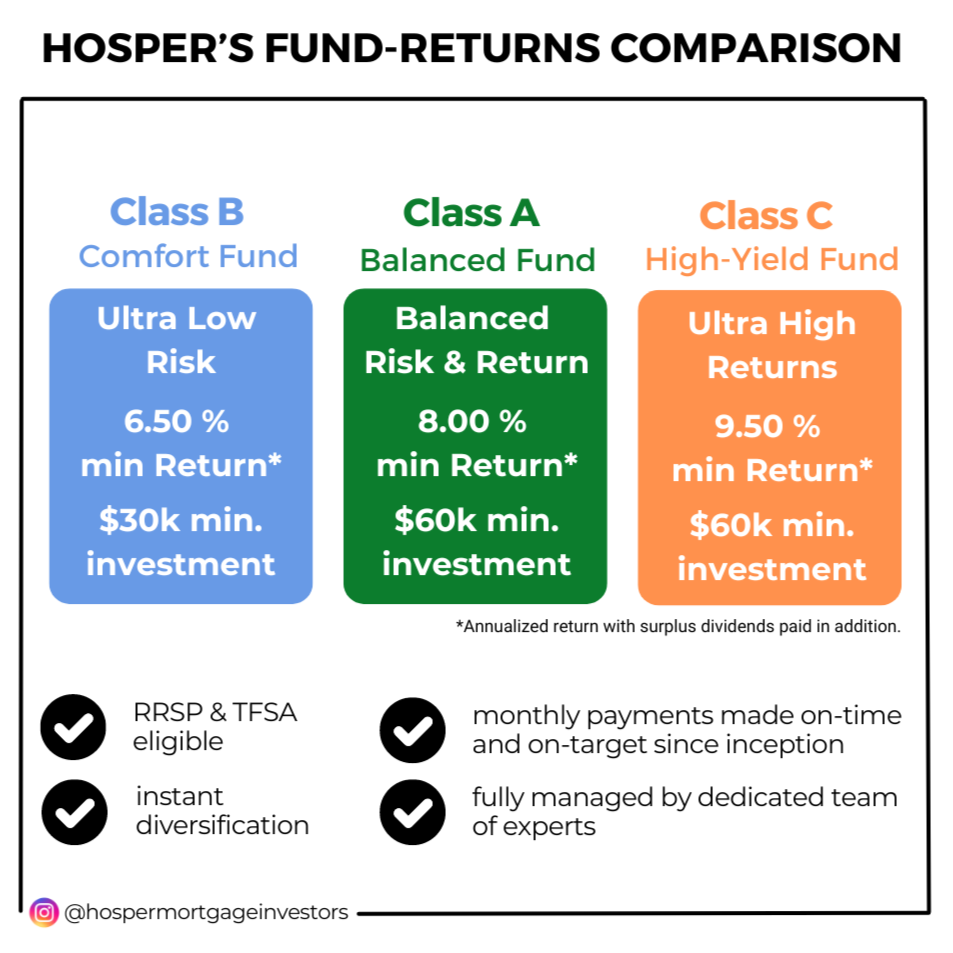

Investing with Hosper MIC offers passive and predictable income backed by Ontario real estate. With a minimum one-year commitment, our preferred shares provide higher security by spreading risk across hundreds of shareholders and mortgages. You don’t need to be a real estate expert to invest in Hosper. You can choose from any of these three options.

Hosper MIC’s program is eligible for TFSA investing. To get started:

- Complete the onboarding process (Class A, Class B, Class C) for the class you want to invest in.

- Follow the OTC Registered Funds: Step-By-Step Guide to open or transfer your TFSA at Olympia Trust Company.

- Purchase Hosper shares through your Olympia account.

- Confirm with Investment Service Team at

This email address is being protected from spambots. You need JavaScript enabled to view it. once the shares have been purchased.

Alternatively, we offer a Direct Mortgage Investing (DMI) program. Designed for experienced investors, this option lets you manage your investments hands-on with the possibility of higher returns. We offer tens to hundreds of new loans each month to choose from, with options ranging from low to high risk. Use this simple DMI Checklist to get started with your first investment with Hosper Mortgage.

Please note that Hosper does not charge any management fees. If you have any questions, feel free to contact our investment team at

Want to estimate the growth of your investment? Check out our Compound calculator.

.png)