What is LTV – Private Mortgage Investing Basics

Jad Cherri, CFA

September 10, 2025

In understanding how to invest in private mortgages, one of the most important numbers to understand is the loan-to-value ratio (LTV). If you’re wondering what is LTV, or what is LTV in a mortgage loan, the answer is simple but extremely important.

This ratio indicates how much of a property’s value finances the loan and how much equity protects it. A fast way to check for indications of default risk. It also helps find out how much equity buffer is available if things don’t go as planned.

Unlike public real estate investments, private mortgage lending doesn’t rely on property growth or high market prices. It relies on income and collateral. The loan-to-value ratio is the metric that keeps those two things in balance, which is why so many private lenders use it as their first screening tool.

Hosper Mortgage uses LTV as a cornerstone of our risk management approach, ensuring every loan is structured with strong protection for our investors through the Paragon Process.

What is LTV?

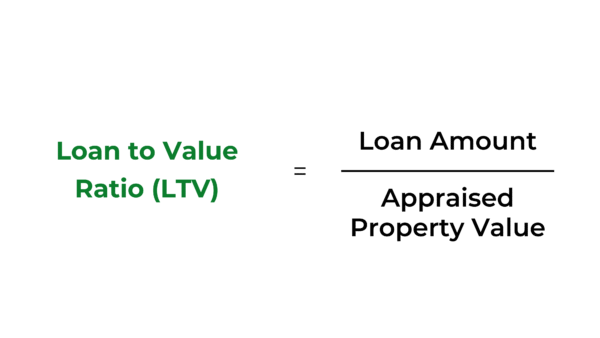

The loan-to-value ratio is a simple percentage that compares the loan amount with the value of the property. It tells lenders and investors what percentage of the property is financed with debt. A lower percentage means more borrower equity and more protection for the lender.

How To Calculate LTV:

Loan-to-Value = (Loan Amount ÷ Market Value of Property) × 100

For example, if a property is worth $800,000 and the mortgage is $520,000, the ratio is 65%.

This means the borrower has 35% equity and the lender is protected by that equity.

When people ask how to calculate LTV or how is LTV calculated, this is all it means. Even though it looks like a technical term, it’s fundamentally just a simple math formula used to measure safety.

In home loan LTV scenarios, banks also look at credit scores and income. In private lending, the loan-to-value ratio is often the primary measurement because the income and credit situation of the borrower may not fit normal banking rules. In this case, the property value and the equity behind the loan become even more important, which is why this ratio is carefully reviewed.

Why It Matters in Private Lending

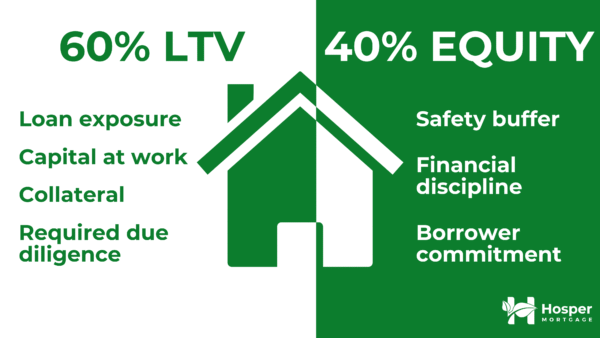

In private lending, the LTV ratio directly affects default risk, interest rate, and exit strategy.

A lower percentage means the borrower has more of their own money tied up in the deal and is less likely to walk away. If the borrower does default, there’s also more equity buffer available to cover costs, interest, and potentially recover the principal through a sale.

For example, if the ratio is 65%, the lender has a 35% buffer before their capital is at risk.

If the ratio is 85%, the lender only has a 15% cushion, which can disappear very quickly if the property value drops or if legal costs are high.

Another important factor is the exit strategy. Private mortgages often have shorter terms (6 to 12 months). This means the borrower needs a clear plan for how they will repay or refinance the loan at maturity. A lower loan-to-value ratio gives the borrower more flexibility. They can refinance into a conventional mortgage or sell the property and still repay the loan.

When the ratio is high, refinancing gets harder, and the borrower may need to sell the property quickly or find a new private lender.

That’s why experienced private investors always look at the loan-to-value together with the exit strategy. The two go hand in hand.

In a mortgage investment corporation (MIC), hundreds of individual loans are typically pooled together. By combining these loans, the overall loan-to-value is balanced across the portfolio, which helps diversify and reduce risk for investors, depending on the weighted average LTV of the fund.

Hosper works closely with borrowers to evaluate both LTV and exit strategies, ensuring loans are structured to benefit both parties while protecting investor capital.

The Role of Appraisals

To calculate a reliable ratio, you need an accurate value. That’s where the home property appraisal comes in.

Private lenders use common appraisal methods in real estate, such as the comparable sales method or cost approach, to determine fair market value. Some lenders use internal appraisers, while others hire independent professionals so the value is verified by a third party.

If the appraisal is inflated, the ratio will look lower (and safer) than it really is.

For example, if a property is valued at $1,000,000 but the real market value is closer to $850,000, a 70% loan becomes more like an 82% loan in reality.

That is why a strong valuation process is critical in private mortgage investing. The ratio is only as accurate as the appraisal.

Different LTVs and What They Mean

Different LTV ratios come with different levels of risk and equity buffer. The table below gives a quick summary:

| Level | Equity Buffer | Risk | Implications |

|---|---|---|---|

| 50% LTV Mortgage | Very strong | Very low | Borrower has large equity; strong protection for lender. |

| 65% LTV Mortgage | Strong | Low | Common in private lending; good balance between return and protection. |

| 70% LTV Mortgage | Moderate | Moderate | Acceptable for experienced borrowers and stable properties. |

| 75% LTV Mortgage | Reduced | Elevated | Less equity cushion; lender should verify strong exit strategy. |

| 80% LTV Mortgage | Thin | High | Minimal equity buffer; used only in special cases. |

| 85% LTV Mortgage | Very thin | Very high | Rarely used in private lending; high exposure for the lender. |

| 90-100% LTV Mortgage | None | Extreme | Only used in niche cases; exit strategy must be very solid. |

In general, the lower the ratio, the more protection for the lender.

For this reason, most private investments stay in the 60–70% range.

75% may still be acceptable in cases where the property is in a very strong market and the borrower has a clear and realistic repayment plan.

How Private Investors Use the Ratio

Most experienced private investors start by asking two basic questions about any deal:

- What is the loan-to-value on the property?

- What is the borrower’s exit strategy?

If the ratio is low (for example, 60–65%), there is usually enough protection to proceed even if the borrower has a complex credit profile. The focus then shifts to the property’s condition and the legal structure of the loan.

If the ratio is higher (for example, 80% or 85%), the investor needs to see a very strong exit strategy and a solid valuation to justify the risk. The ability to refinance, the location of the property, and even the type of property (commercial, single-family, multi-family) become much more important as the ratio increases.

Practical Example: Calculating Safety

Let’s say an investor is looking at a loan of $420,000 on a property worth $600,000.

Loan-to-Value = (420,000 ÷ 600,000) × 100 = 70%

That means there is a 30% equity buffer.

If the borrower defaults and the property needs to be sold, the lender has room to cover sales costs, legal fees, and time delays before risking capital.

This is why many private investors consider a 70% loan-to-value to be the upper end of the “comfortable” range.

Now let’s take the same loan with a higher valuation error. If the real value of the property is actually $550,000, the true ratio becomes:

420,000 ÷ 550,000 = 76%

The equity buffer drops from 30% to 24%, and the lender is now exposed to more risk without even changing the loan amount. This simple example shows how important it is to verify value before relying on the ratio.

Common Mistakes When Evaluating Loan-to-Value

Here are a few mistakes newer investors sometimes make when reviewing the loan-to-value ratio in private mortgage investing:

Understanding these points helps investors use the loan-to-value ratio more effectively and avoid overconfidence when reviewing deals.

Final Thoughts

The loan-to-value ratio is one of the most important tools in private mortgage investing.

It tells you how much of the property is financed and how much equity is protecting the loan. A lower ratio provides a stronger equity buffer and a lower default risk, while a higher one requires a strong exit strategy and a firm understanding of the valuation.

By taking the time to calculate and verify this ratio, and by understanding its limits, investors can make better decisions, manage risk, and find opportunities that provide consistent returns without unnecessary exposure.

Whether you’re looking at a 65% loan-to-value or evaluating a possible 75% scenario, always ask how much protection the number truly represents in today’s market. When combined with a solid appraisal and realistic exit strategy, it becomes one of the most reliable ways to measure safety in private mortgage investing.

You may also like

Relevant Articles

The best time to invest in real estate was yesterday. The second best time is now. Join thousands of investors who trust Hosper to grow and protect their wealth.