What is a Mortgage Investment Corporation?

Garry Jhamb, JD

September 8, 2025

If you’ve been looking into how to invest in private mortgages, you’ve likely come across the term Mortgage Investment Corporation (MIC). MICs are a uniquely Canadian way for investors to pool money together and fund real estate loans. They create steady income while offering security through property-backed lending.

But what is a MIC, and how does it work in practice? This article will explain what a mortgage investment corporation is.

It will also discuss why they are popular in Canada. We will look at the risks and rewards. Finally, we will see how companies like Hosper Mortgage help investors join this type of investment.

What Is a MIC?

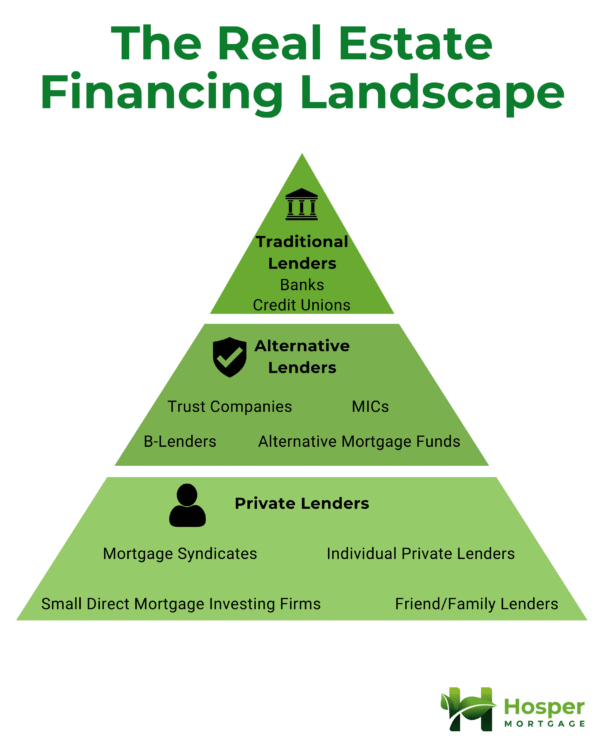

A Mortgage Investment Corporation (MIC) is a company that pools money from multiple investors and uses it to fund hundreds of mortgages. Instead of one person lending a large sum directly, known as direct mortgage investing, many people contribute smaller amounts, spreading out the risk.

MICs are regulated under the Canadian Income Tax Act of 1973. They allow regular investors to invest in private mortgages. This way, they do not have to manage the complex lending process themselves.

Here’s the basic idea:

This makes MICs a common way for Canadians to learn about investing in private mortgages. They also enjoy diversification and income.

Why MICs Are Growing in Canada

Over the past decade, Canadian banks have become much stricter with mortgage approvals. According to recent research on Canadian mortgage lending trends, alternative lenders like MICs have become increasingly important as traditional mortgage qualification has tightened. Many borrowers, such as self-employed workers, entrepreneurs, or those with unique financial situations, can’t get loans through traditional channels. As of the first quarter of 2025, total outstanding non-bank residential mortgages in Canada stood at CA $396.8 billion, according to research from Statistics Canada.

Mortgage Investment Corporations in Canada fill this gap by providing short-term, property-backed loans. For investors, this means more opportunities to earn consistent income.

Borrowers who turn to MICs often include:

Why investors are drawn to MICs:

For many Canadians, MICs are a practical way to participate in the real estate market without having to buy or manage a property.

MICs vs. Other Mortgage Investment Funds

MICs are often compared to other mortgage investment funds like REITs, but they have important differences. Under Canadian law:

This setup makes Canadian mortgage investment corporations especially attractive compared to other pooled real estate funds.

How Investors Earn with MICs

Investors in MICs earn money through the interest borrowers pay.

For example:

Returns can change based on the market. However, most mortgage investment corporations in Canada aim to provide annual returns of 6% to 10%.

For many, this is much higher than GICs or government bonds, making MICs a strong choice for fixed income investments in Canada.

Risks to Consider

Every investment carries risk, and MICs are no exception. Here are the main ones:

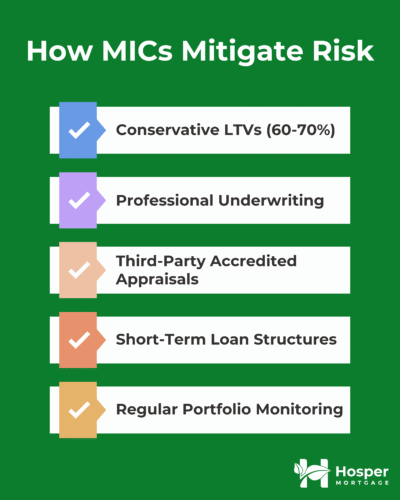

How MICs lower risk:

That’s why choosing the right MIC is so important. Companies like Hosper Mortgage reduce these risks by lending carefully. They keep loan-to-value (LTV) ratios at safe levels. They also focus on short-term loans with clear repayment plans.

Hosper Mortgage and MIC Investing

At Hosper Mortgage, the focus is on protecting investor capital while delivering consistent returns. By carefully evaluating borrowers and properties, Hosper ensures that loans are safe and well-structured.

Hosper’s approach to mortgage investment opportunities includes:

For those exploring how to invest in private mortgages, Hosper makes the process simple while keeping security top of mind. Hosper’s Paragon Process is in place to further ensure protection of capital.

Who Should Consider a MIC?

MICs are best for investors who want:

MICs are especially appealing to retirees or anyone looking for fixed income investments in Canada that provide regular cash flow.

How to Invest in Private Mortgages Through a MIC

For new investors, the idea of private lending can seem complex. MICs make it straightforward. Here’s a step-by-step look at how to invest in private mortgages through a MIC:

- Research MICs: Look for firms with strong track records and transparent reporting.

- Review offering documents: Each MIC has an information package that explains returns, risks, and structure.

- Decide your commitment: Minimums vary but are often lower than Direct Mortgage Investing.

- Purchase shares in the MIC: Your investment is pooled with others to fund mortgages.

- Receive Dividends: Most MICs pay monthly or quarterly, giving you a steady stream of income.

- Reinvest or withdraw: Depending on the MIC, you can reinvest your earnings or take cash payouts.

The process is designed to be straightforward, so even first-time investors can participate without needing deep financial knowledge or experience in real estate.

Opportunities in Mortgage Investing

MICs represent one of the strongest mortgage investment opportunities in Canada. With housing demand remaining high, there’s no shortage of borrowers who need access to alternative lending.

For investors, this means:

Hosper Mortgage provides these opportunities by building carefully managed mortgage portfolios, ensuring that investors benefit from both security and performance.

Tax Treatment of MICs in Canada

One of the key things investors need to understand is how returns from a mortgage investment corporation are taxed. Unlike regular corporations, a mortgage investment corporation in Ontario or elsewhere in Canada does not pay income tax.

Instead, all profits are passed directly to shareholders. Investors then pay tax on the income they receive, which is treated as interest income. This means it is taxed at the investor’s marginal tax rate, just like other forms of passive income.

The good news is that with Hosper, investors can hold their MIC shares inside registered plans such as a TFSA, RRSP, or RESP contribution account. This flexibility makes mortgage investment corporations in Ontario and across Canada a powerful tool for investors looking to balance growth, income, and tax efficiency.

MICs vs. Other Fixed Income Options

Let’s compare:

In terms of other Canadian mortgage investments, it is worth looking into how MICs compare to direct mortgage investing. For many Canadians, MICs strike the right balance between safety and reward.

They provide higher yields than traditional products, yet remain more stable than equities, making them a useful middle ground for balanced portfolios.

The Future of MICs in Canada

As banks tighten mortgage rules and demand for housing stays strong, mortgage investment corporations will continue to play a larger role. They provide real solutions for borrowers and reliable returns for investors.

Looking ahead, MICs are likely to grow in importance as:

Industry experts predict that MICs will continue to expand over the next decade, especially in urban markets where housing demand is strong and traditional financing is often harder to secure.

With trusted managers like Hosper Mortgage, investors can feel confident knowing their money is being used in carefully selected, property-backed loans.

Final Thoughts

So, what is a mortgage investment corporation? In simple terms, it’s a Canadian company that lets investors pool money to fund private mortgages and earn relatively hassle-free income from the interest borrowers pay.

For investors, MICs provide:

At Hosper Mortgage, we believe MICs and related mortgage investment funds are a smart option for investors who want steady returns and peace of mind. By focusing on conservative lending and transparency, we help investors grow their wealth safely.

You may also like

Relevant Articles

The best time to invest in real estate was yesterday. The second best time is now. Join thousands of investors who trust Hosper to grow and protect their wealth.