The Paragon Process – Mortgage Investing Risk Mitigation

Jad Cherri, CFA

February 6, 2026

If you are looking at mortgage investment opportunities in Canada, you are probably asking two questions:

- What returns can I earn?

- How do I protect investments if something goes wrong?

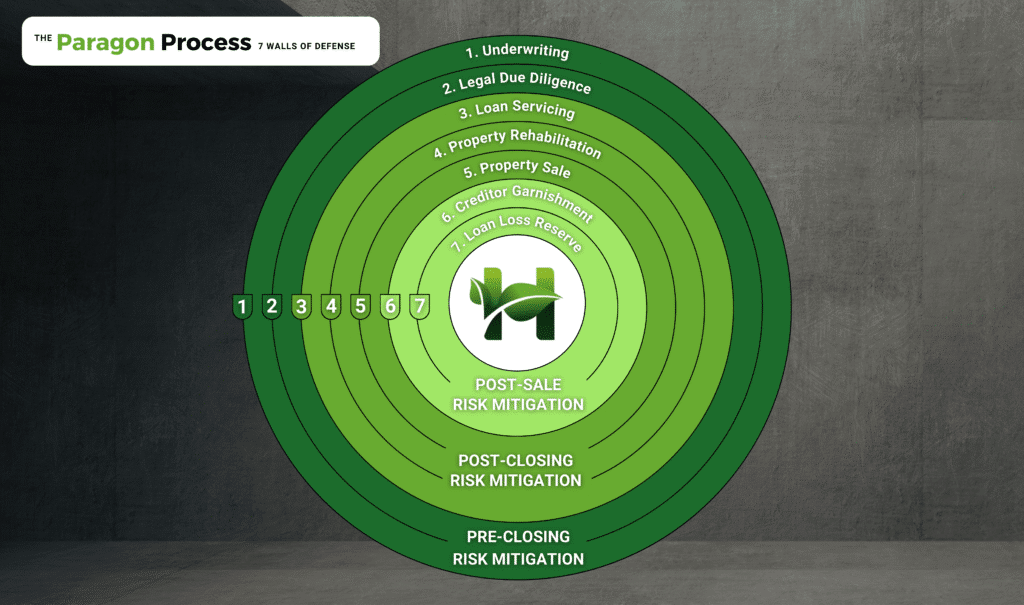

Returns matter, but capital protection matters just as much. That is why Hosper built the Paragon Process, a 7-step risk mitigation system designed to protect investor capital from the first underwriting call to the final recovery action.

This guide explains Hosper’s framework and is written for people exploring how to invest in private mortgages, private mortgage investing, private lending, and Mortgage Investment Corporation (MIC) options, and who want safe investments with high returns in Canada without taking blind risk.

What is the Paragon Process?

The Paragon Process is Hosper’s “7 walls of defense” for every mortgage investment. Hosper splits the process into three phases:

Pre-closing risk mitigation

- Underwriting

- Legal due diligence

Post-closing risk mitigation

- Loan servicing

- Property rehabilitation

- Property sale

Post-sale risk mitigation

- Creditor garnishment

- Loan loss reserve

Each wall is meant to reduce default risk, limit investment risk, and improve recovery outcomes if a loan ever moves into enforcement.

Pre-closing risk mitigation

Pre-closing risk mitigation happens before any funds are advanced, and it focuses on verifying the borrower, confirming the property value, and ensuring the mortgage is legally secure before the loan closes.

1. Underwriting: disciplined decisions before funding

Good underwriting is where most risk is won or lost. Hosper treats underwriting as the first and most important layer of mortgage investment risk mitigation.

Appraisal for mortgage loan

Every file starts with a home property appraisal covered by the loan completed by an approved third-party appraiser or valuation expert. The goal is simple: confirm the property’s real market value before money goes out the door.

Why it matters: if the value is wrong, the risk default profile of the whole deal changes.

Home loan underwriting and borrower fit

Home loan underwriting is not just about credit score. Hosper reviews income sources, liquidity, credit history, and the borrower’s plan to repay. The key question is: does the exit strategy work in real life? What is ultimately key to Hosper’s underwriting is the property.

A clear exit strategy lowers default risk and supports consistent performance.

Loan to value (LTV) rules

Loan to value, also written as LTV, is one of the cleanest ways to measure risk. Lower LTV usually means more equity buffer and less chance of loss in a forced sale.

Hosper keeps LTV under target to reduce downside exposure and protect investor capital. If you want the basics, see Hosper’s blog on what is LTV.

2. Legal due diligence: protect the mortgage’s enforceability

Even a great property and borrower can become a problem if the legal foundation is weak. Hosper’s legal due diligence focuses on enforceability, clarity, and fraud prevention.

Title and writ search

Hosper orders a full title and writ search to confirm ownership and checks for liens, judgments, or writs that could affect the mortgage. This is a core part of mortgage underwriting and lender protection.

Fraud prevention checks

Hosper verifies borrower details and property information to reduce fraud risk. This step is about preventing surprises after closing.

Title insurance

Hosper requires title insurance. Investors often ask what does title insurance cover. In simple terms, title insurance can protect against certain title defects, fraud, and errors that may not show up in a search.

Another common question is property title insurance cost. Cost varies by province, property, and insurer, so it is not one number. What matters is that title insurance is a low-cost layer of protection compared to the legal cost of a title issue.

Post-closing risk mitigation

Post-closing risk mitigation begins immediately after the mortgage funds, and focuses on monitoring performance, supporting the borrower, and protecting the property so investor capital stays secure throughout the life of the loan.

3. Loan servicing: reduce default risk early

Once a loan is funded, the job is not done. Loan servicing is where payment issues are caught early and handled fast.

Dedicated borrower care team

Hosper’s customer care team stays in contact, answers questions, and helps resolve problems before they turn into missed payments.

Collections process for NSF and arrears

Hosper uses a clear, proven process for NSF payments and early arrears. Timely follow-up reduces default risk and improves cash flow stability.

Flexible solutions when they protect capital

Sometimes a structured payment plan or a refinance path is the best risk mitigation move. The goal is not to “win” against the borrower. The goal is to protect investor capital.

If a mortgage is over 60 days in arrears without a clear plan, Hosper may enforce to reduce risk default exposure.

4. Property rehabilitation: protect and improve collateral value

If enforcement happens, the property becomes the focus. A neglected property can lose value fast, especially in harsh weather or if it sits empty.

Inspections and scope

Trusted inspectors identify what the home needs to stay safe, marketable, and compliant.

Renovation planning and cost control

Renovations are not about over-improving. They are about smart work that protects sale value. Hosper works with renovation partners to manage timelines, quality, and cost for renovation.

Property renovations as a part of the Paragon Process highlights protecting the asset so investor capital is not exposed to avoidable value loss.

5. Property sale: maximize recovery with strong execution

When the best path is to sell, execution matters. Poor pricing, weak marketing, or slow action can increase losses.

Power of sale meaning

The meaning of power of sale is simple: it is a legal process that lets a lender sell the property to recover the debt, under specific rules.

Power of sale homes and specialized realtors

It is important that power of sale homes need a realtor who understands the process, the buyer pool, and the right pricing strategy. Hosper works with partners who specialize in power of sale listings to help maximize recovery value.

If you want the full process explained, see Hosper’s power of sale blog.

Post-sale risk mitigation

Post-sale risk mitigation applies after the property has been sold, and focuses on recovering any remaining balances and protecting investor capital through additional legal and financial safeguards.

6. Creditor garnishment: pursue remaining balances when appropriate

Sometimes, a sale does not cover every dollar owed. When the law allows it and when it makes sense, Hosper can pursue creditor garnishment.

Creditor garnishment can include court-ordered seizure of wages or assets to settle outstanding balances after sale. This step can reduce the final loss and further protect investor capital.

7. Loan loss reserve: the final safeguard for MIC investors

For investors in a Mortgage Investment Corporation, a strong loss reserve matters.

Hosper MIC maintains a fully funded loan loss reserve. It is a dedicated pool meant to absorb rare losses that slip through the other six walls of defense.

This loss reserve is held independently and is not used for operations. It is there to protect shareholder capital in the MIC.

To learn more about structures, see Hosper’s blogs on what is a MIC and MIC vs direct mortgage investing.

How the Paragon Process helps protect investments

The Paragon Process is built around a simple idea: reduce the chance of loss, and reduce the size of loss if default happens.

Here is what the seven walls are designed to do:

Hosper doesn’t rely on one tactic. It is a full risk mitigation system.

How to protect investments: a quick checklist

How to protect investments in private mortgage investing is about stacking safeguards. Before you commit to any private mortgage lending investment, confirm the lender can explain:

If the answers are vague, risk default exposure is usually higher than it looks.

How to invest in private mortgages with a risk-first mindset

If you are researching how to invest in private mortgages, you will usually see two paths:

Direct lending

You invest into a specific mortgage. This is often called direct mortgage investing or private mortgage lending investment. It can offer more control per deal, but you also carry deal-specific risk.

Pooled investing through a MIC

You invest into a Mortgage Investment Corporation that holds many mortgages. This can spread risk across a portfolio, and may include added protections like a loss reserve.

What to look for in private mortgage investing

No matter which route you choose, ask these questions:

These questions are not academic. They are how you protect investments.

Final thoughts

Private lending can be a strong way to access canadian mortgage investments, but only when risk is managed with discipline. Hosper’s Paragon Process is designed to protect investor capital at every stage, from mortgage underwriting to post-sale recovery.

If you are comparing mortgage investment options and want safe investments with high returns in Canada, focus on the process, not just the rate. Risk mitigation is what keeps returns real over the long-term.

You may also like

Relevant Articles

The best time to invest in real estate was yesterday. The second best time is now. Join thousands of investors who trust Hosper to grow and protect their wealth.