Assisting Brokerages Funding Their Mortgage Deals

Fund More Residential Mortgage Deals with Hosper

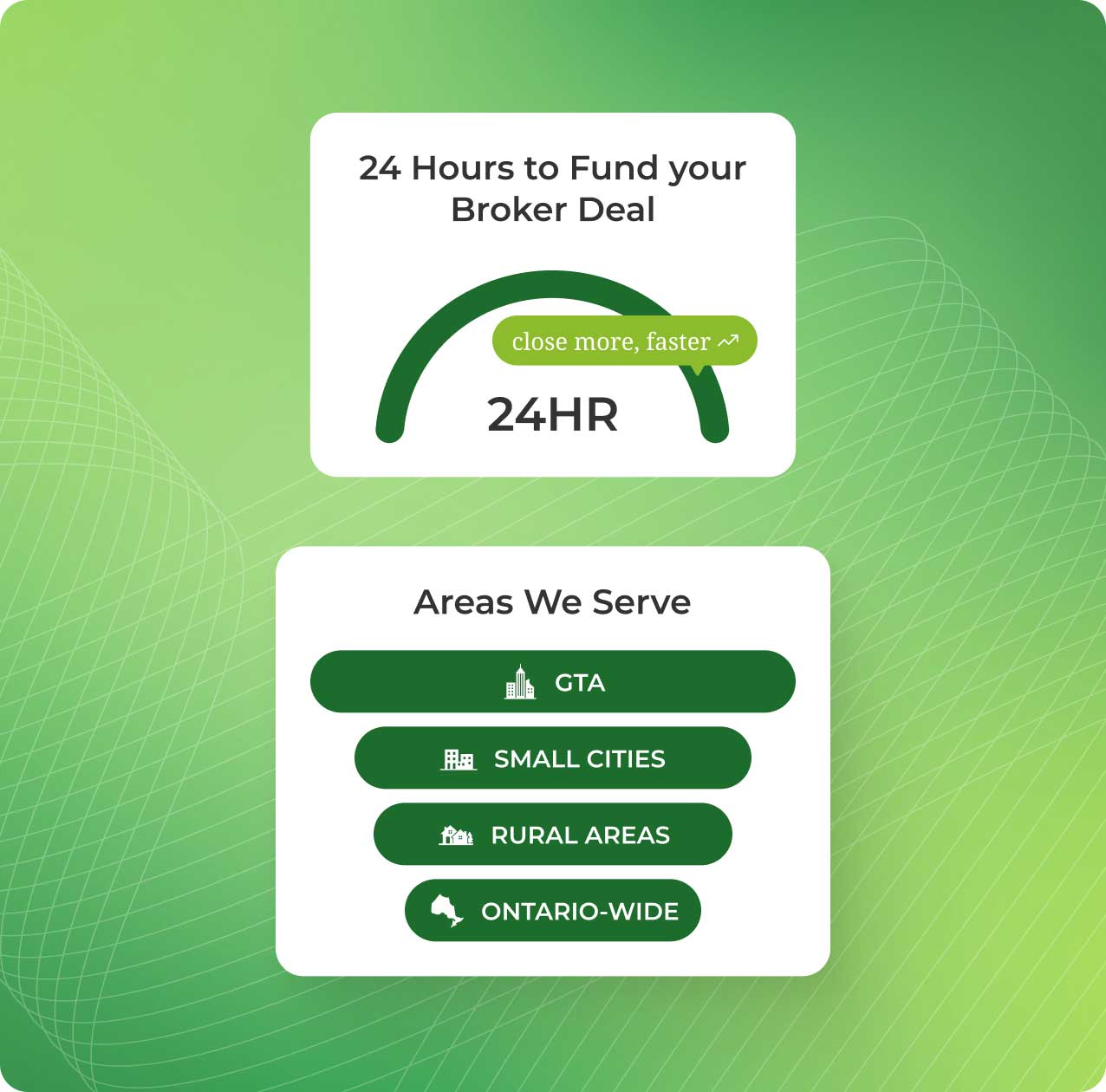

Ontario‑wide alternative mortgage lending for brokers who need speed and flexibility. Get to “yes” in hours, not weeks.

Residential 1st, 2nd, and 3rd mortgages across Ontario. Equity‑based underwriting, interest‑only payments, and fast commitments so you can fund more files.

Ontario‑wide Coverage. Urban, Suburban, Small Town, and Rural

Where Your Clients Live, We Lend

You send the scenario. We return a same‑day view and, when the file fits, a commitment before day’s end. Need to close on a rush purchase in 24 hours or less? We can do that on qualifying files. After‑5pm and weekend support is available.

Equity‑based underwriting with practical structure, not a “fit in the box” mindset.

Ontario‑wide lending. Deals from $30k to $1MM.

Penalty is the lesser of 3 months’ interest or interest to maturity.

When You Need To Combine Mortgages

We Structure Mortgages so Brokers Can Unlock the Proceeds They Need.

We can fund a Hosper second behind an existing first, or pair a Hosper first and second on the same property. We underwrite to the combined loan‑to‑value on the file, not just the new position.

For qualified scenarios, we can consider registering security on more than one property under a single facility (often called inter alia, or a blanket mortgage) to right‑size the advance. Final structure is case‑by‑case with legal counsel.

Testimonials

What Brokers Say

One of, if not, the best lender to work with. As a broker, we appreciate their quick turnaround times and creative solutions that help us secure the most suitable mortgage products for our clients.

Dyson and his team was very helpful when it comes to underwriting and closing the transaction smoothly. I highly appreciate Team Hosper for providing the best and quick service for my clients.

Always great to deal with. Hosper is a great lender for brokers looking to find solutions for their clients.

Very good option for an equity MIC. Minimal docs. Very quick. Lots of options. Jerry and the underwriting team are excellent communicators.

Shawn & Jerry at Hosper form one of my favourite private lenders to deal with. They make everything clear & easy.

I found the staff at Hosper — especially Sarthak Behal — extremely helpful in closing the transaction. I will definitely do business with Hosper again.

Contact Us

Partner With Hosper To Fund Your Residential Deals

We work with licensed mortgage brokers to fund fast, common-sense residential firsts and seconds and thirds across Ontario. Get same-day feedback and clear terms.

Our experts will walk you through the options and help tailor a mortgage funding plan to your clients’ needs.

We Respond Within 2 Business Hours